题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The equity beta of Fence Co is 0·9 and the company has issued 10 million ordinary shares.

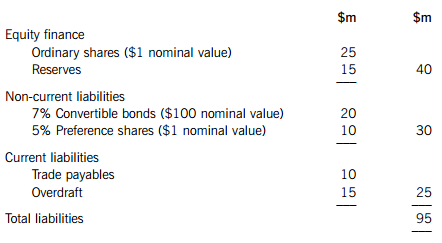

Fence Co plans to invest in a project which is different to its existing business operations and has identified a company in the same business area as the project, Hex Co. The equity beta of Hex Co is 1·2 and the company has an equity market value of $54 million. The market value of the debt of Hex Co is $12 million.

The risk-free rate of return is 4% per year and the average return on the stock market is 11% per year. Both companies pay corporation tax at a rate of 20% per year.

Required:

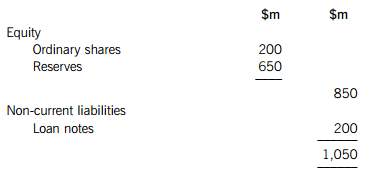

(a) Calculate the current weighted average cost of capital of Fence Co. (7 marks)

(b) Calculate a cost of equity which could be used in appraising the new project. (4 marks)

(c) Explain the difference between systematic and unsystematic risk in relation to portfolio theory and the capital asset pricing model. (6 marks)

(d) Discuss the differences between weak form, semi-strong form. and strong form. capital market efficiency, and discuss the significance of the efficient market hypothesis (EMH) for the financial manager. (8 marks)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The equity beta of Fence Co is…”相关的问题

更多“The equity beta of Fence Co is…”相关的问题