题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A financial market may be thought of as ordinary market in which traders may buy or sell p

A.Right

B.Wrong

C.Doesn't say

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.Right

B.Wrong

C.Doesn't say

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“A financial market may be thou…”相关的问题

更多“A financial market may be thou…”相关的问题

Money market securities are ______.

A.essentially issued by governments, financial institutions, and large corporations

B.very liquid and earns high return

C.denominated in small sums so that individual investors can deal in them

D.purchased by individual investors directly

Which of the following financial instruments will NOT be traded on a money market?

A.Commercial paper

B.Convertible loan notes

C.Treasury bills

D.Certificates of deposit

A.the seller

B.the buyer

C.the broker

D.the dealer

authorised for issue must be adjusted in the financial statements?

1 Declaration of equity dividends.

2 Decline in market value of investments.

3 The announcement of changes in tax rates.

4 The announcement of a major restructuring.

A 1

A 1 only

B 2 and 4

C 3 only

D None of them

A.with spot rate

B.with forward rate

C.at the market price

D.at the price fixed at the time of the deal

A.1 and 2 only

B.1 and 3 only

C.2 and 3 only

D.1, 2 and 3

The Royal Swedish Academy of Sciences awarded the Nobel Prize in economics to three Americans,Eugene Fama,Lars Peter Hansen and Robert Shiller on Oct.14,2013.Eugene Fama and Lars Peter Hansen are both professors at the University of Chicago.Robert Shiller is a professor at Yale University.They will share the prize worth about 1.2 million dollars.

"This year's prize in economic sciences is about predictions." All three of this year's prize winners are mainly known for their research and explanations of pricing forces in financial markets.They have had a big influence on the way people look at and talk about financial markets.

Eugene Fama's research on financial markets in the 1960s led market watchers to change their ideas about investing.His ideas are linked to the theory that markets are efficient,which means market actors taking all available information to create the correct price for things at any given time.This also means that over short periods of time,it is not possible to predict prices.

Robert Shiller found,however,that over long periods,the opposite is true.It is possible to predict the movement of prices and that price changes are linked to human behavior.

The findings of both economists have led to the growth of index funds,investing many different securities as a way to reduce risk.Mr Shiller also helped to create the Standard & Poor's Case-Shiller home prices index.That index follows home prices across the United States.

Lars Peter Hansen developed a method for studying historical pricing information.His method supports Mr Shiller's findings and has influenced efforts to predict prices in the financial industry.

The Nobel Prize in economics was not created by Alfred Nobel,but was established in his memory by Sweden's central bank in 1968.

1.The Royal Swedish Academy of Sciences awarded the Nobel Prize in electronics to three Americans on Oct.14,2013.

2.Eugene Fama,Lars Peter Hansen and Robert Shiller won the prize for their research and explanations of pricing forces in financial markets.

3.Eugene Fama's research on financial markets in the 1960s resulted in some change in how market watchers look at investing.

4.The findings of both economists have led to the growth of price prediction,investing many different securities as a way to reduce risk.

5.The Nobel Prize in economics was established in memory of Alfred Nobel by Sweden's central bank in 1968.

(d) Sirus raised a loan with a bank of $2 million on 1 May 2007. The market interest rate of 8% per annum is to

be paid annually in arrears and the principal is to be repaid in 10 years time. The terms of the loan allow Sirus

to redeem the loan after seven years by paying the full amount of the interest to be charged over the ten year

period, plus a penalty of $200,000 and the principal of $2 million. The effective interest rate of the repayment

option is 9·1%. The directors of Sirus are currently restructuring the funding of the company and are in initial

discussions with the bank about the possibility of repaying the loan within the next financial year. Sirus is

uncertain about the accounting treatment for the current loan agreement and whether the loan can be shown as

a current liability because of the discussions with the bank. (6 marks)

Appropriateness of the format and presentation of the report and quality of discussion (2 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

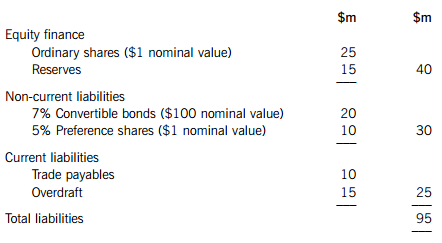

The statement of financial position of BKB Co provides the following information:

BKB Co has an equity beta of 1·2 and the ex-dividend market value of the company’s equity is $125 million. The ex-interest market value of the convertible bonds is $21 million and the ex-dividend market value of the preference shares is $6·25 million.

The convertible bonds of BKB Co have a conversion ratio of 19 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years’ time. The current ordinary share price of BKB Co is expected to increase by 4% per year for the foreseeable future.

The overdraft has a variable interest rate which is currently 6% per year and BKB Co expects this to increase in the near future. The overdraft has not changed in size over the last financial year, although one year ago the overdraft interest rate was 4% per year. The company’s bank will not allow the overdraft to increase from its current level.

The equity risk premium is 5% per year and the risk-free rate of return is 4% per year. BKB Co pays profit tax at an annual rate of 30% per year.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of BKB Co, explaining clearly any assumptions you make. (12 marks)

(b) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (4 marks)

(c) Comment on the interest rate risk faced by BKB Co and discuss briefly how this risk can be managed. (5 marks)

(d) Discuss the attractions to a company of convertible debt compared to a bank loan of a similar maturity as a source of finance. (4 marks)