题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Under the guidance of their teacher, the pupils are building a model boat ________ by

A.hauled

B.towed

C.tossed

D.propelled

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.hauled

B.towed

C.tossed

D.propelled

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“Under the guidance of their te…”相关的问题

更多“Under the guidance of their te…”相关的问题

(a) The existing standard dealing with provisions IAS 37, Provisions, Contingent Liabilities and Contingent Assets, has been in place for many years and is sufficiently well understood and consistently applied in most areas. The IASB feels it is time for a fundamental change in the underlying principles for the recognition and measurement of non-financial liabilities. To this end, the Board has issued an Exposure Draft, ‘Measurement of Liabilities in IAS 37 – Proposed amendments to IAS 37’.

Required:

(i) Discuss the existing guidance in IAS 37 as regards the recognition and measurement of provisions and why the IASB feels the need to replace this guidance; (9 marks)

(ii) Describe the new proposals that the IASB has outlined in the Exposure Draft. (7 marks)

(b) Royan, a public limited company, extracts oil and has a present obligation to dismantle an oil platform. at the end of the platform’s life, which is 10 years. Royan cannot cancel this obligation or transfer it. Royan intends to carry out the dismantling work itself and estimates the cost of the work to be $150 million in 10 years time. The present value of the work is $105 million.

A market exists for the dismantling of an oil platform. and Royan could hire a third party contractor to carry out the work. The entity feels that if no risk or probability adjustment were needed then the cost of the external contractor would be $180 million in ten years time. The present value of this cost is $129 million. If risk and probability are taken into account, then there is a probability of 40% that the present value will be $129 million and 60% probability that it would be $140 million, and there is a risk that the costs may increase by $5 million.

Required:

Describe the accounting treatment of the above events under IAS 37 and the possible outcomes under the proposed amendments in the Exposure Draft. (7 marks)

Professional marks will be awarded in question 4 for the quality of the discussion. (2 marks)

Required:

(a) (i) Discuss the main weaknesses in the current standard on revenue recognition; (11 marks)

(ii) Discuss the reasons why it might be relevant to take into account credit risk and the time value of money in assessing revenue recognition. (5 marks)

Professional marks will be awarded in part (a) for clarity and expression of your discussion. (2 marks)

(b) (i) Venue enters into a contract with a customer to provide computers at a value of $1 million. The terms are that payment is due one month after the sale of the goods. On the basis of experience with other contractors with similar characteristics, Venue considers that there is a 5% risk that the customer will not pay the amount due after the goods have been delivered and the property transferred. Venue subsequently felt that the financial condition of the customer has deteriorated and that the trade receivable is further impaired by $100,000.

(ii) Venue has also sold a computer hardware system to a customer and, because of the current difficulties in the market, Venue has agreed to defer receipt of the selling price of $2 million until two years after the hardware has been transferred to the customer.

Venue has also been offering discounts to customers if products were sold with terms whereby payment was due now but the transfer of the product was made in one year. A sale had been made under these terms and payment of $3 million had been received. A discount rate of 4% should be used in any calculations.

Required: Discuss how both of the above transactions would be treated in subsequent financial statements under IAS 18 and also whether there would be difference in treatment if the collectability of the debt and the time value of money were taken into account. (7 marks)

(b) Comment on the need for ethical guidance for accountants on money laundering. (4 marks)

The author implies what the troubled boys needed most was _________.

A.strict guidance in proper behavior

B.challenging demand in hard work

C.sympathy and tolerance from adults

D.understanding and trust from others

It is just as well that Mr Smith was delegated (委派) to our company for guidance work,or our company would have ______ defeat.

A.suffered

B.lacked

C.encountered

D.comanded

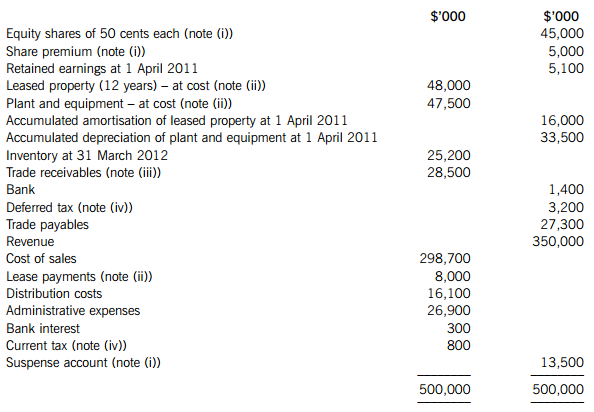

The following trial balance relates to Fresco at 31 March 2012:

The following notes are relevant:

(i) The suspense account represents the corresponding credit for cash received for a fully subscribed rights issue of equity shares made on 1 January 2012. The terms of the share issue were one new share for every five held at a price of 75 cents each. The price of the company’s equity shares immediately before the issue was $1·20 each.

(ii) Non-current assets:

To reflect a marked increase in property prices, Fresco decided to revalue its leased property on 1 April 2011. The Directors accepted the report of an independent surveyor who valued the leased property at $36 million on that date. Fresco has not yet recorded the revaluation. The remaining life of the leased property is eight years at the date of the revaluation. Fresco makes an annual transfer to retained profits to reflect the realisation of the revaluation reserve. In Fresco’s tax jurisdiction the revaluation does not give rise to a deferred tax liability.

On 1 April 2011, Fresco acquired an item of plant under a finance lease agreement that had an implicit finance cost of 10% per annum. The lease payments in the trial balance represent an initial deposit of $2 million paid on 1 April 2011 and the first annual rental of $6 million paid on 31 March 2012. The lease agreement requires further annual payments of $6 million on 31 March each year for the next four years. Had the plant not been leased it would have cost $25 million to purchase for cash.

Plant and equipment (other than the leased plant) is depreciated at 20% per annum using the reducing balance method.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2012. Depreciation and amortisation are charged to cost of sales.

(iii) In March 2012, Fresco’s internal audit department discovered a fraud committed by the company’s credit controller who did not return from a foreign business trip. The outcome of the fraud is that $4 million of the company’s trade receivables have been stolen by the credit controller and are not recoverable. Of this amount, $1 million relates to the year ended 31 March 2011 and the remainder to the current year. Fresco is not insured against this fraud.

(iv) Fresco’s income tax calculation for the year ended 31 March 2012 shows a tax refund of $2·4 million. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2011. At 31 March 2012, Fresco had taxable temporary differences of $12 million (requiring a deferred tax liability). The income tax rate of Fresco is 25%.

Required:

(a) (i) Prepare the statement of comprehensive income for Fresco for the year ended 31 March 2012.

(ii) Prepare the statement of changes in equity for Fresco for the year ended 31 March 2012.

(iii) Prepare the statement of financial position of Fresco as at 31 March 2012.

The following mark allocation is provided as guidance for this requirement:

(i) 9 marks

(ii) 5 marks

(iii) 8 marks (22 marks)

(b) Calculate the basic earnings per share for Fresco for the year ended 31 March 2012. (3 marks)

Notes to the financial statements are not required.